Private Aircraft, Tax Cuts and Jobs Act

On December 22, 2017, the President of the United States signed The Tax Cuts and Jobs Act. Currently, the federal government imposes an excise tax on every commercial flight. Under this new legislation, the maintenance of a privately managed and operated plane would be exempt from this tax.

Below is the section of the bill which describes the tax breaks for aircraft owners:

“The proposal exempts certain payments related to the management of private aircraft from the excise taxes imposed on taxable transportation by air. Exempt payments are those amounts paid by an aircraft owner for management services related to maintenance and support of the owner’s aircraft or flights on the owner’s aircraft.

Applicable services include support activities related to the aircraft itself, such as its storage, maintenance, and fueling, and those related to its operation, such as the hiring and training of pilots and crew, as well as administrative services such as scheduling, flight planning, weather forecasting, obtaining insurance, and establishing and complying with safety standards. Aircraft management services also include such other services as are necessary to support flights operated by an aircraft owner.”

Q: How does this new tax reform affect the aviation industry and purchase of private aircraft?

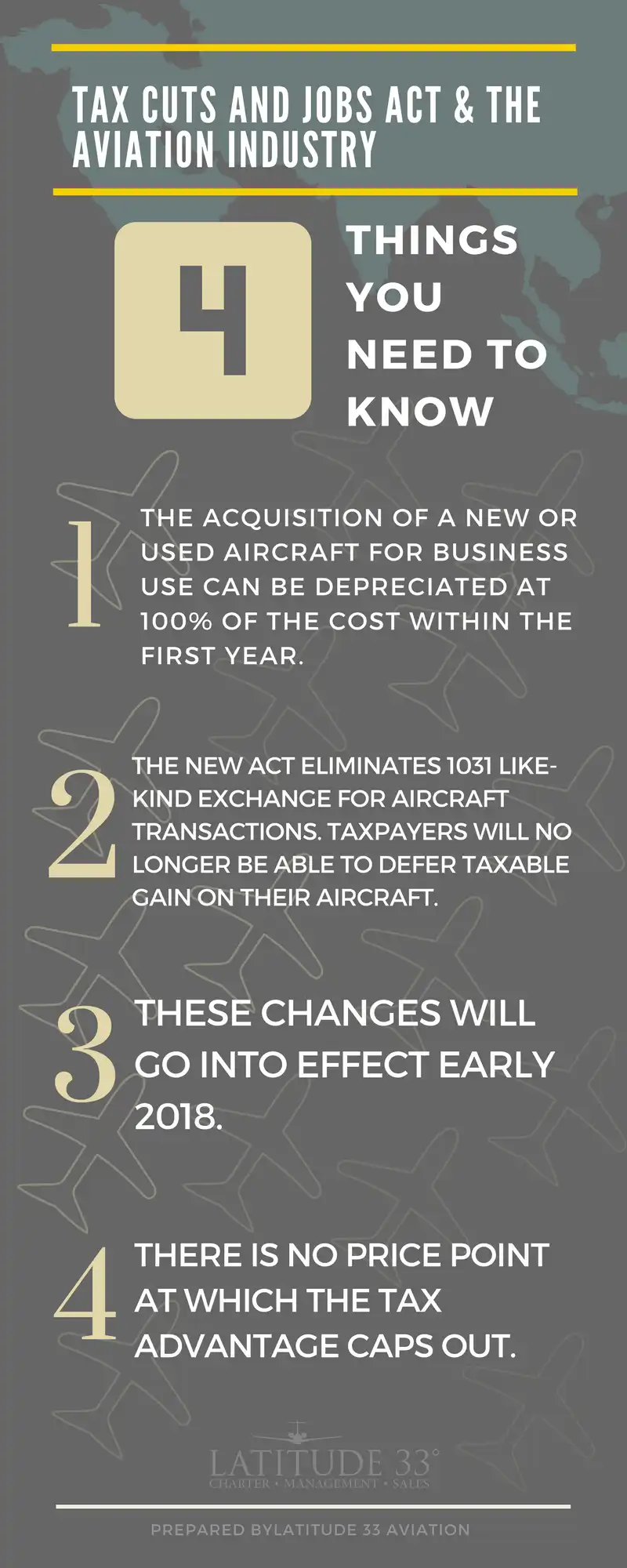

A: The acquisition of an aircraft for business could be depreciated at 100% of the cost within the first year of ownership. This is an immediate, important change from previous tax guidelines. For example, based on a marginal tax rate of 40% and a jet acquisition price of $5,000,000 there is a potential income tax savings of $2,000,000.

Q: Is there a difference between the acquisition of a pre-owned aircraft vs. a factory-new aircraft?

A: No, the tax reform applies to both new and pre-owned aircraft.

Q: Is there a cap or phase-out to deduction price point?

A: No, there is no purchase price point at which the tax advantage caps out. The tax benefits would apply to a seasoned jet owner upgrading to a Citation Longitude, as well as a first-time aircraft owner looking to purchase a single-engine turboprop aircraft.

Q: I would like to purchase an aircraft soon, should I wait?

A: Now is the perfect time to buy an aircraft as the new incentives are very advantageous. Although the new Tax Cut eliminates the like-kind exchange (1031 exchange) for aircraft transactions (in 2018 the Act will only allow the 1031 like-kind exchange for real property) and taxpayers will no longer be able to defer taxable gain on their aircraft when they wish to upgrade, the new tax cuts applicable to buying a new plane are immediate and significant.

Q: What if I wish to deduct entertainment expenses for my business aircraft?

A: Previously, deductions of entertainment expenses are only allowed if they directly relate to the taxpayer’s conduct of business. Starting in 2018, the new tax cut does not allow the deduction of entertainment expenses, regardless if it associated with the owner’s/taxpayer’s business.

Q: Great! I am ready to purchase my aircraft. Now what?

A: Contact the experts on our jet acquisition service team at 800-840-0310 or AircraftSales@L33Jets.com. Latitude 33 Aviation is glad to help you through this process – we are an industry-recognized group of experts delivering professional, full-service aircraft ownership programs. Latitude 33 will handle every aspect of the private jet acquisition process for you including market analysis, aircraft selection, contract negotiations, legal and tax referrals, facility selection, on-site pre-buy representation and jet pilot mentoring. We will gladly answer any questions and help you through the acquisition process.

Not quite ready to purchase? Check our charter page for additional private flight options and services.

To view our current inventory of jet aircraft for sale please visit: Latitude 33 Aviation: Aircraft Inventory

For more information about The Tax Cuts and Jobs Act please visit: U.S. Congress Website